Revolutionizing Safety: Japan’s Cutting-Edge Innovations in Earthquake Early Warning Systems

Introduction Japan is a global leader in earthquake preparedness, thanks to its pioneering advancements in earthquake early warning systems (EEWS). Given the country's vulnerability to seismic activity, continuous innovation in technology plays a vital role in minimizing damage and saving lives during earthquakes. This article explores Japan’s technological breakthroughs in earthquake early warning systems, highlighting how these innovations contribute to disaster resilience and public safety. The Urgent Need for Earthquake…

Definition of Financial Covenant

Trending

A Complete History of Basketball: From Its Origins to a Global Phenomenon

Introduction Basketball is one of the most popular sports worldwide, loved for its fast pace,…

The Miracle Air of Isole Tremiti: The Hidden Islands of Italy

Nestled in the crystal-clear waters of the Adriatic Sea, the Isole Tremiti archipelago is a…

The Revolution of Mobile Banking Transactions and Future Challenges

Introduction The rapid evolution of technology has transformed the way people manage their finances, with…

Latest News

3 Recommended Foods to Boost Oral Health

Maintaining a healthy mouth is essential not only for a beautiful smile but also for overall health. Nutrition plays a key role in oral…

China Last Training Goalkeeper Test Indonesia Match

Introduction As the China National Football Team prepares to face Indonesia in an eagerly awaited football match, the final training…

3 Recommended Foods to Boost Oral Health

Maintaining a healthy mouth is essential not only for a beautiful smile but also for overall health. Nutrition plays a…

Dow Jones Industrial Average

Featured

Bayesian Network principles in economics

Introduction to Bayesian Networks Bayesian Network is a probabilistic graphical model that…

Israel’s UN Ambassador Vows Relentless Attacks on Iran Until Nuclear Threat is Eliminated

Introduction In a powerful and resolute address to the United Nations Security…

Cold Shower vs Warm Shower: Which One is Truly Healthier

Introduction Taking a shower is a daily ritual for most people, but…

Tips for Product Analysis to Sell Online with High Buyer Demand

Introduction Success in online selling largely depends on choosing the right products…

Skin Fasting Explained: The Natural Way to Rejuvenate Your Skin

Introduction Skin fasting has become a popular trend in the beauty and…

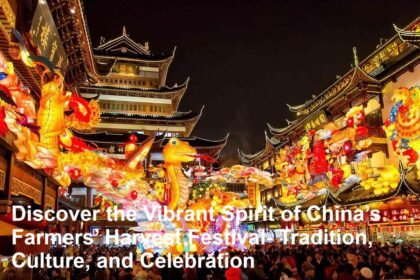

Discover the Vibrant Spirit of China’s Farmers’ Harvest Festival: Tradition, Culture, and Celebration

Introduction China’s Farmers’ Harvest Festival is a colorful and joyous celebration that…

More News

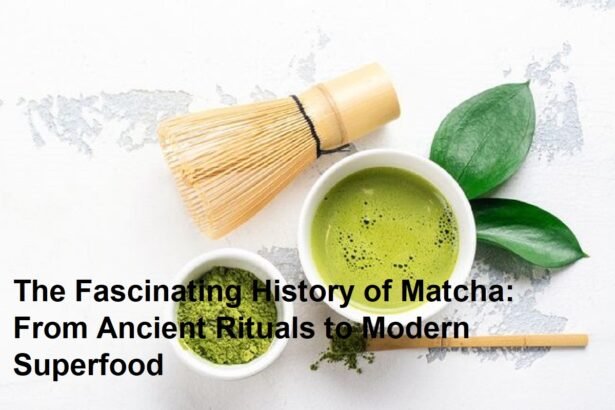

The Fascinating History of Matcha: From Ancient Rituals to Modern Superfood

Matcha, a vibrant green powdered tea, has gained immense popularity worldwide in recent years as a healthful beverage and culinary…

The Phenomenon of Online Store Entrepreneurs Migrating from Tokopedia to TikTok Shop

Introduction: Understanding the Migration Trend in E-Commerce In recent years, the e-commerce landscape in Indonesia has witnessed a noticeable trend:…

Indonesia National Team Training Camp in Bali Ahead of China Match

Introduction The Indonesia National Football Team has embarked on a crucial training camp in the beautiful island of Bali as…

Understanding Blockchain Technology and Its Real-World Applications

Introduction Blockchain technology has rapidly emerged as one of the most transformative innovations of the 21st century. Originally conceptualized as…

China Last Training Goalkeeper Test Indonesia Match

Introduction As the China National Football Team prepares to face Indonesia in an eagerly awaited football match, the final training…

Cold Shower vs Warm Shower: Which One is Truly Healthier

Introduction Taking a shower is a daily ritual for most people, but the debate over whether cold showers or warm…

Prabowo Subianto Meets Vladimir Putin in St. Petersburg

Introduction On Wednesday, June 18, 2025, Prabowo Subianto, the Indonesian Minister of Defense, landed at Pulkovo International Airport in St.…

Is It Safe to Never Shut Down Your Laptop? Debunking Myths and Optimizing Performance

In today's fast-paced digital landscape, laptops have become indispensable tools for work, communication, and entertainment. A common question among laptop…

The Charm of Ibiza and Es Vedra: Temporarily Closed Paradise

Ibiza, a gem of the Mediterranean and a hotspot for travelers worldwide, is renowned for its breathtaking landscapes, vibrant nightlife, and unique cultural experiences. Among its many attractions, the mystical rock formation Es Vedra stands out as an enigmatic symbol of natural beauty and legend. However, recent news reports that these iconic destinations are temporarily closed Es Vedra: The Mystical Rock Es Vedra, a towering limestone rock rising 413 meters…

Trending

Discover Android 16: Innovative Features Elevating Your Mobile Experience in 2025

Introduction Android 16, the newest iteration of Google's mobile operating system, launched in June 2025,…

Benefits of Purchasing Managers Index (PMI)

Introduction to PMI and its Role in the Economy PMI or Purchasing Managers' Index is…

Master the Calf Raise: Benefits, Technique, and Tips for Stronger Legs

Introduction Calf raises are a fundamental exercise targeting the calf muscles, which play a crucial…

Featured

Recognizing the Drawbacks of Varicose Veins in the Legs

Introduction Varicose veins are a common condition affecting many people globally, especially…

Top Inflation-Proof Investments: Secure Your Wealth Against Rising Prices

Introduction Inflation erodes the purchasing power of money, making it critical for…

Unlocking Financial Freedom: Top Passive Income Ideas for Employees in 2025

In today's dynamic economic landscape, employees are increasingly looking for ways to…

Indonesia and Russia Agree to Develop Peaceful Nuclear Project

Introduction On June 18, 2025, Indonesian Minister of Defense Prabowo Subianto met…

The Environmental Impact of Online Gaming

Introduction In today’s digital era, online gaming has surged in popularity, captivating…

Discovering Kobe, Japan: A Must-Visit Travel Destination

Introduction Kobe, a vibrant port city located in the Hyogo Prefecture of…

Latest News

Understanding Hanbok: Korea’s Traditional Attire and Fascinating Facts

Hanbok, the traditional Korean clothing, is a vibrant symbol of Korea's rich cultural heritage. Steeped in centuries of history, this elegant attire captivates with…

Iran’s Swift Retaliation: 30 Missiles Launched at Israel’s Ben Gurion Airport After U.S. Strike

Introduction In a significant escalation in Middle East tensions, Iran has responded rapidly and forcefully to a recent American attack…

Avoid These 5 Causes That Make Your Car Interior Smell Bad

Introduction A pleasant-smelling car interior is essential for a comfortable and enjoyable driving experience. However, certain common causes can make…